NOTICE OF 20192021 ANNUAL MEETING OF STOCKHOLDERS AND

PROXY STATEMENT

MGP INGREDIENTS, INC.

Cray Business Plaza 100 Commercial Street

Atchison, Kansas 66002

April 26, 2021

NOTICE OF ANNUAL MEETING

To the Stockholders:

At this meeting, you will consider and votebe asked to:

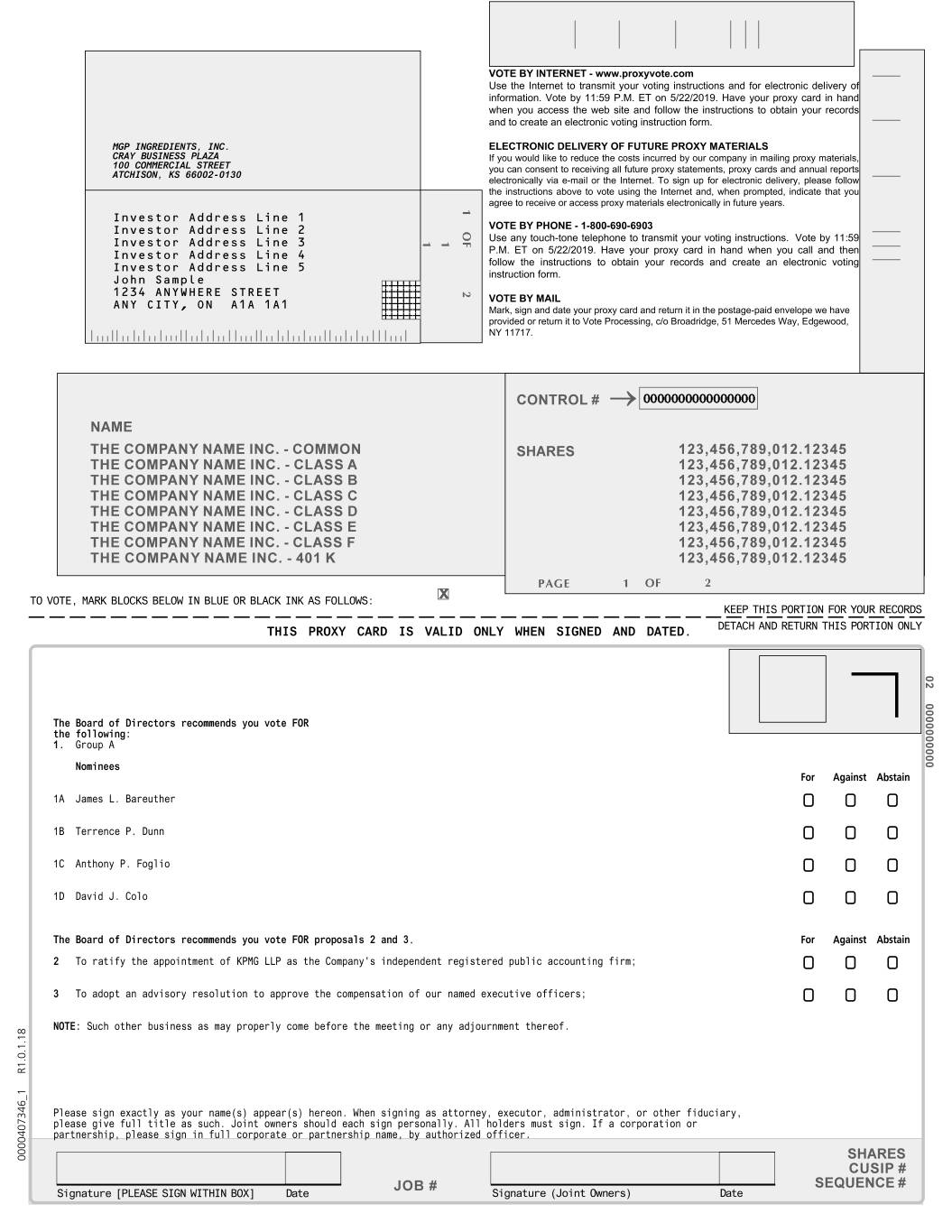

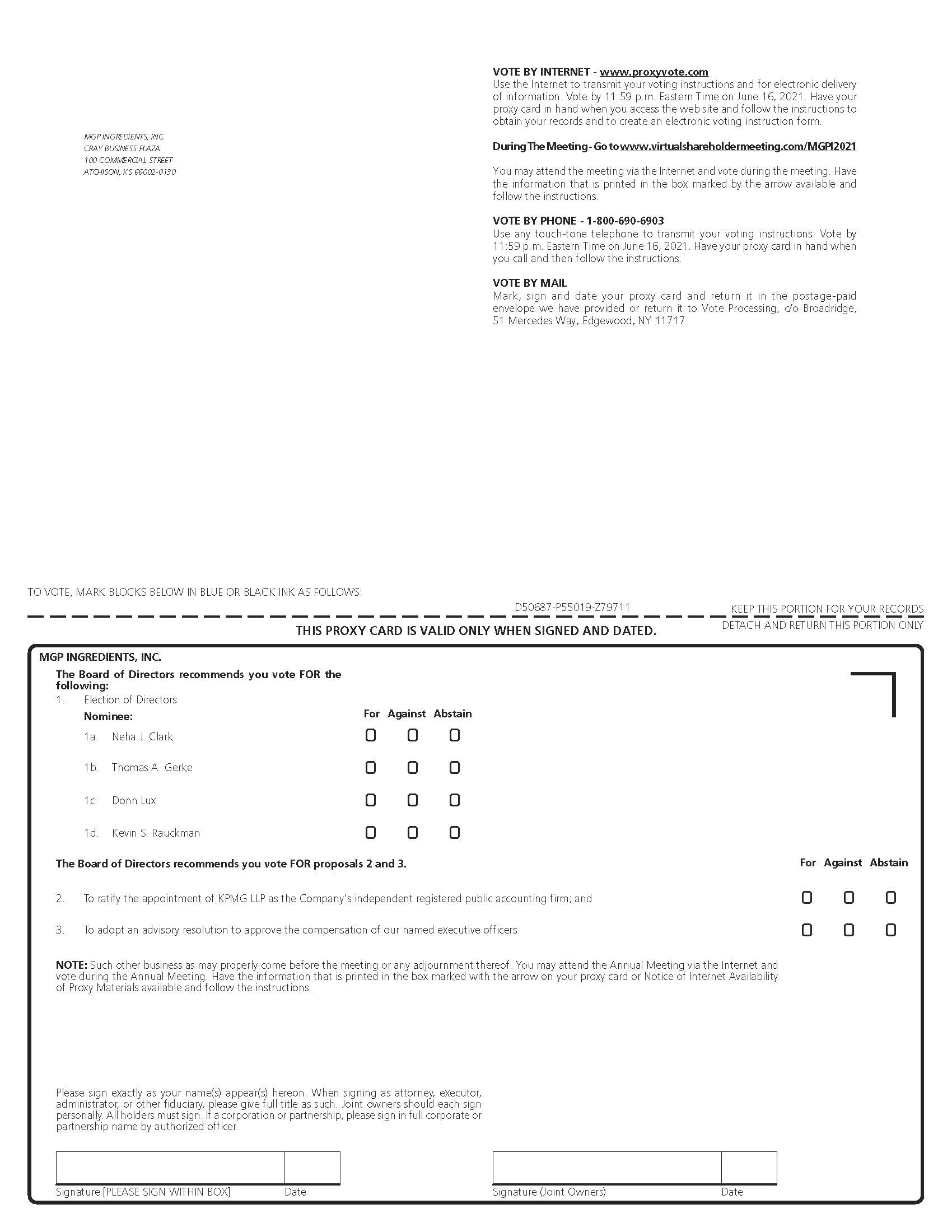

1.Elect eight (8)nine (9) directors;

2.Ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm;

3.Adopt an advisory resolution to approve the compensation of our named executive officers; and

4.Transact such other business as may properly come before the meeting.

The record date for determining which stockholders may vote at this meeting or any adjournment is March 25, 2019.April 19, 2021.A complete list of stockholders entitled to vote at the Annual Meeting will be posted on the virtual meeting website during the meeting.

We are distributing our proxy materials to our stockholders primarily via the Internet under the “Notice and Access” rules of the Securities and Exchange Commission (“SEC”). This approach saves printing and mailing costs and reduces the environmental impact of our Annual Meeting, while providing a convenient way to access the materials and vote. On April 9, 2019,26, 2021 we are mailing a Notice of Internet Availability of Proxy Materials to stockholders of record at the close of business on March 25, 2019,April 19, 2021, containing instructions about how to access our proxy materials and vote online or vote by telephone.

Please review the instructions on each of your voting options described in this proxy statement and in the notice you received by mail. Your vote is important. Whether or not you plan to attend the Annual Meeting, PLEASE VOTE AS SOON AS POSSIBLE.

By Order of the Board of Directors

Karen Seaberg

Chairman of the Board

PROXY STATEMENT

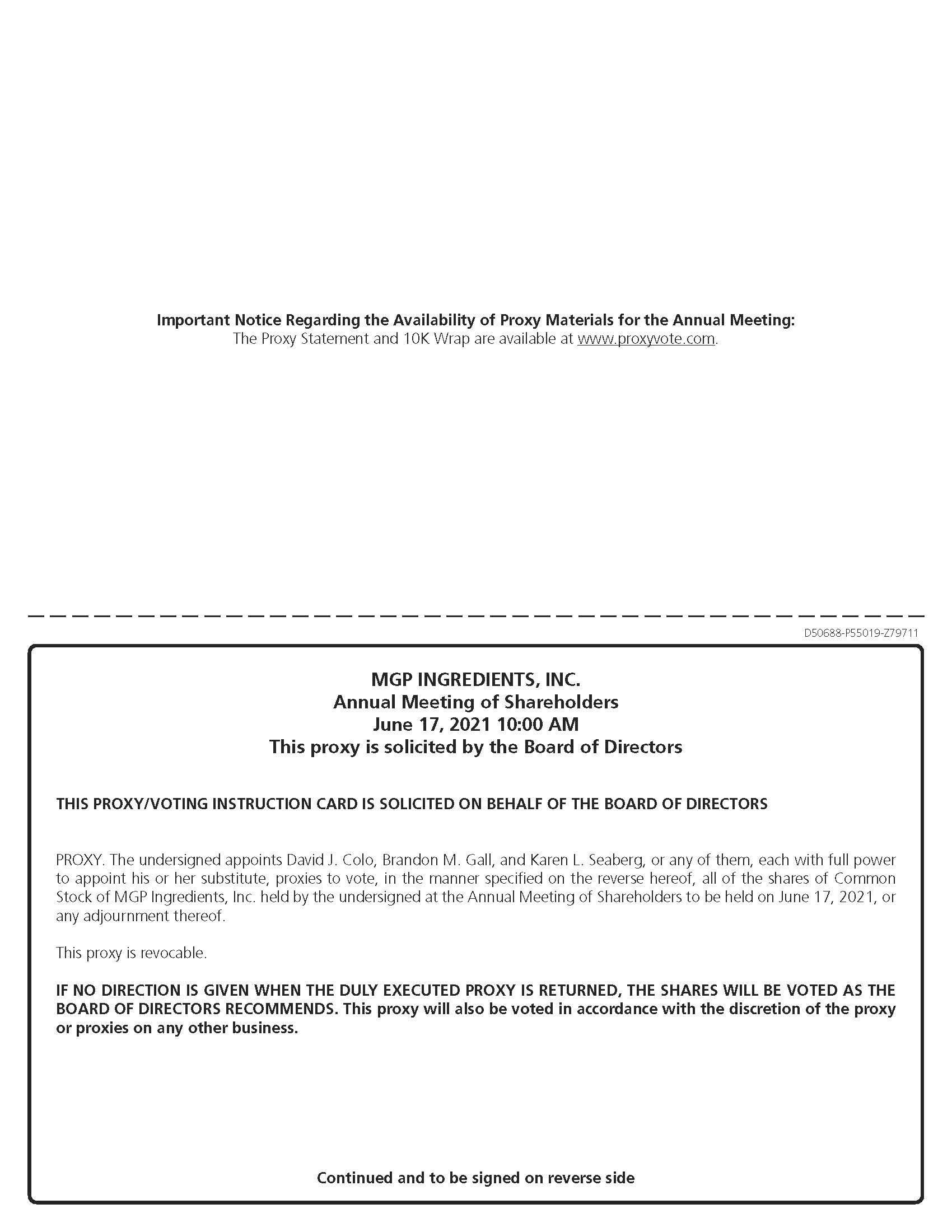

We are providing this proxy statement (the “Proxy Statement”) to you on the Internet, or upon your request, have delivered a printed version of this Proxy Statement to you by mailing in connection with the solicitation by the Board of Directors of MGP Ingredients, Inc. (the “Company”) of proxies to be voted at our Annual Meeting of its stockholders to be held on May 23, 2019June 17, 2021 (including any adjournment or postponement thereof).

These materials were first sent or made available to stockholders on or about April 9, 201926, 2021 and include:

•The Notice of the Company’s 20192021 Annual Meeting of Stockholders;

•This Proxy Statement; and

•The Company’s Annual Report on Form 10-K for the year ended December 31, 2018,2020, as filed with the SEC.

If you requested print versions by mail, these proxy materials also include the proxy card or voting instruction form for the Annual Meeting.

Use of “Notice and Access”

Pursuant to rules adopted by the SEC, we use the Internet as the primary means of furnishing proxy materials to stockholders. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or how to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our annual meetings, and reduce the cost to the Company associated with the physical printing and mailing of materials.

VOTING MATTERS

How You Can Vote

Voters include recordholders and persons holding MGP stock through a broker or other nominee.

Stock Held of Record. If you are a stockholder of record, there are four ways to vote:

Telephone Voting. If you requested printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the proxy card.

Voting By Mail. If you requested printed copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and returning it in the envelope provided.

Stock Held Through a Broker or Other Nominee. If your shares are held in a brokerage account at a brokerage firm, bank, broker-dealer or similar organization, then you are the “beneficial owner” of shares held in “street name,” and a Notice was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote your shares. Those instructions are contained in a “voting instruction form.” If you request printed copies of the proxy materials by mail, you will receive a voting instruction form. AsIf you are a beneficial owner and you are also invitedwant to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at thevirtual Annual Meeting, unless you obtain a legal proxy fromshould contact your broker, bank or other nominee and present itas soon as possible so that you can be provided with a control number to gain access to the inspectors of election at the Annual Meeting with your ballot.online meeting.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, under applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. The only routine matter for which your broker will be permitted to vote on your behalf without your instructions is the proposal related to the selection of KMPGKPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2019.2021. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspectorsinspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

If you are a beneficial owner of shares held in street name, there are four ways to vote:

Telephone Voting. If you requested printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the voting instruction form.

Voting By Mail. If you requested printed copies of the proxy materials by mail, you may vote by proxy by filling out the voting instruction form and returning it in the envelope provided.

How You May Revoke or Change Your Vote

You may revoke your proxy at any time before it is voted at the meeting by:

•sending timely written notice of revocation to the corporate secretary;

•submitting another timely proxy by telephone, Internet or mail; or

•attending the virtual meeting and voting online. If voting online at the virtual Annual Meeting, you may do so by going to www.virtualshareholdermeeting.com/MGPI2021 and following the voting in person. If voting in person, please bring written evidence confirming your ownership of the shares you wish to vote.instructions. If you hold shares through a trustee, broker or nominee, you may recast your vote or revoke your proxy by timely following the procedures of the trustee, broker or nominee. Without further action,

As with last year, we are conducting this year's Annual Meeting entirely online.We will continue to provide our stockholders with an opportunity to ask questions.

Attendance at the Virtual Annual Meeting

To join the online Annual Meeting, login at www.virtualshareholdermeeting.com/MGPI2021. You will need your attendance atunique 16-digit control number, which is included on the Notice or your proxy card you received.If your shares are in "street name," you will need to contact your broker, bank or other nominee as soon as possible so that you can be provided with a control number to gain access to the online meeting.

The live audio of the webcast of the Annual Meeting will not automatically revoke your proxy.begin promptly at 10:00 a.m., Central Daylight Time.Online access to the audio webcast will open approximately 30 minutes prior to the start of the meeting to allow time for the stockholders to log in and test the computer audio system.We encourage you to log in prior to the meeting start time.Beginning 30 minutes prior to the start of and during the online Annual Meeting, we will have a support team ready to assist stockholders with any technical difficulties they might have accessing or hearing the audio webcast of the meeting.If you encounter technical difficulties accessing the audio webcast, please call our support team at 800-586-1548 (U.S.) or 303-562-9288 (International).

If you are unable to attend the online meeting, a replay of the meeting will be posted on our investor relations website (at https:/ir.mgpingredients.com) for at least thirty (30) days after the meeting concludes.

2

How to Ask Questions at the Online Annual Meeting.Meeting

Other Voting Matters

The holders of record of the Company’s common stock, no par value (“Common Stock”), and the Company’s preferred stock, $10 par value (“Preferred Stock”), at the close of business on March 25, 2019April 19, 2021 are entitled to notice of and to vote at the Annual Meeting. As of March 25, 2019,April 19, 2021, there were 17,014,88221,950,862 shares of Common Stock outstanding and 437 shares of Preferred Stock outstanding. You are entitled to one vote for each share owned of record on that date.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting in accordance with your instructions. If you sign your proxy card but do not give voting instructions, the shares represented by the proxy will be voted by those named in the proxy card in accordance with the recommendations of the Board of Directors.

If any other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy card will have the discretion to vote on those matters for you. As of the printingdate of this Proxy Statement, we do not know of any other matter to be presented at the Annual Meeting.

How Votes are Counted and Voting Requirements

Quorum. For you to approve proposals at the 20192021 Annual Meeting, we must have a quorum. A quorum means the holders of a majority of the shares of each class of MGP stock outstanding on the record date are present at the Annual Meeting. Proxies received but marked as abstentions or treated as broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. A broker non-vote occurs when a broker has not received directions from customers and does not have discretionary authority to vote the customers’ shares on a non-routine matter. If a quorum is not present at the scheduled time of the meeting, the stockholders who are represented may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given.

Votes Required for Approval. Generally, holders of Common Stock and Preferred Stock each vote separately as a class with respect to each matter that the class is authorized to vote on, with each share of stock in each class being entitled to one vote.

Proposal 1 – Elect Eight (8)Nine (9) Directors. Election of Group A directors is determined by a majority of votes cast (meaning the number of shares voted "for" a nominee must exceed the number of shares voted "against" such nominee).If any nominee for Group A director receives a greater number of votes "against" his or her election than votes "for" such election, our Corporate Governance Guidelines require that such person must promptly tender his or her resignation to the Board following certification of the vote.Abstentions and broker non-votes are not considered votes cast for the foregoing purpose, and will have no effect on the election of Group A nominees.Holders of Common Stock are entitled to vote on the election of the Group A directors only.Election of Group B directors is determined by a plurality vote (meaning the candidates for office who receive the highest number of votes of the class entitled to vote on such director position will be elected). Holders of Preferred Stock are entitled to vote on the election of the Group B directors only. Because it is a plurality vote, abstentions and withheld votes will have no effect on the election of Group B nominees. Broker non-votes are disregarded and will not affect the determination of a plurality.

Proposal 2 – Ratify the Appointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm. Ratification of KPMG LLP as MGP’s independent registered public accounting firm requires the affirmative vote of a majority of the shares of Common Stock and Preferred Stock of MGP that are entitled to vote and that are present in person or by proxy at the Annual Meeting. Abstentions will have the same effect as a vote against the proposal. Ratification of the independent registered public accounting firm is considered a routine matter and, accordingly, broker non-votes cannot occur.

Proposal 3 – Adopt an Advisory Resolution to Approve the Compensation of our Named Executive Officers. Adoption of the resolution (referred to as “Say-on-Pay”) requires the affirmative vote of a majority of the shares of Common Stock and Preferred Stock of MGP that are entitled to vote and that are present in person or by proxy at the Annual Meeting. Abstentions will have the

3

same effect as a vote against the proposal. Broker non-votes will be treated as shares present for quorum purposes but not entitled to vote, so they will not affect the outcome of the vote on this proposal.

All other Proposals – All other proposals require the affirmative vote of holders of a majority of shares of Common Stock and a majority of shares of Preferred Stock entitled to vote that are present in person or by proxy at the Annual Meeting. Abstentions will have the same effect as a vote against the proposal. Brokers may vote on routine matters but cannot vote on non-routine matters.

The principal executive offices of the Company are located at Cray Business Plaza, 100 Commercial Street, Atchison, Kansas 66002 and the Company’s telephone number at that address is (913) 367-1480.

BOARD AND GOVERNANCE HIGHLIGHTS

The Company has adopted many leading governance practices that establish strong independent leadership in our boardroom and has a strong commitment to Board member diversity. The following is a list of some of our highlights:

•all directors (other than CEO and the President) and all Audit, Human Resources and Compensation, and Nominating and Governance Committee members are independent

•independent lead director

•separate CEO and board chair roles

•44% female representation on the Board, if all nominees are elected at the Annual Meeting

•independent compensation consultant engaged to advise on compensation for our executives and directors

•robust stock ownership requirements for directors and executives

4

PROPOSAL 1 –ELECT EIGHT (8)NINE (9) DIRECTORS

The Board of Directors has nominated each of James L. Bareuther, David J. Colo, Terrence P. Dunn, Anthony P. Foglio, Augustus C. Griffin, Lynn H. Jenkins,Lori L.S. Mingus, Karen L. Seaberg, and M. Jeannine Strandjord, who serve as directors currently, and Neha J. Clark, Thomas A. Gerke, Donn Lux, and Kevin S. Rauckman, who have not previously served as directors, for election as a director, to hold office until the Annual Meeting of stockholders to be held in 20202022 and until their respective successors are duly elected and qualified or until their earlier death, resignation or removal. Information regarding the director nominees is set forth below under the heading “Information Regarding Director Nominees.” George W. Page, Jr., a director of the Company since 2014, is not standing for election. The Nominating and Governance Committee of the Board intends to identify and nominate a candidate for the seat occupied by Mr. Page, and that nominee would stand for election at a future special meeting of the holders of Preferred Stock.

Each nominee has consented to stand for election and the Board does not anticipate that any nominee will be unavailable to serve. If any nominee declines to serve or becomes unavailable for any reason before the election, the proxies may be voted for such substitute nominees as the Board of Directors may designate.

Voting Standard. Proxies will be voted in favor of James L. Bareuther, Terrence P. Dunn, Anthony P. FoglioNeha J. Clark, Thomas A. Gerke, Donn Lux, and David J. ColoKevin S. Rauckman for Group A directors, and Augustus C. Griffin, Lynn H. Jenkins,David J. Colo, Anthony P. Foglio, Lori L.S. Mingus, Karen L. Seaberg, and M. Jeannine Strandjord for Group B directors unless other instructions are given. Holders of Common Stock are entitled to vote on the election of the Group A directors only and holders of Preferred Stock are entitled to vote on the election of the Group B directors only. Group A directors are elected by a majority of votes cast.Abstentions and broker non-votes are disregarded in determining the outcome of the vote.Group B directors are elected by a plurality of votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors and the nominees who receive the most votes will be elected. Votes may be cast in favor of a director or withheld. Withheld votes and broker non-votes are disregarded in determining a plurality.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF JAMES L. BAREUTHER, DAVID J. COLO, TERRENCE P. DUNN,NEHA J. CLARK, ANTHONY P. FOGLIO, AUGUSTUS C. GRIFFIN, LYNN H. JENKINS,THOMAS A. GERKE, DONN LUX, LORI L.S. MINGUS, KAREN L. SEABERG, KEVIN S. RAUCKMAN, AND M. JEANNINE STRANDJORD AS DIRECTORS OF THE COMPANY.

5

PROPOSAL 2 – RATIFY THE APPOINTMENT OF KPMG LLP AS THE

COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANT

The Board of Directors, upon recommendation of its Audit Committee, recommends that you ratify the appointment of KPMG LLP as our independent registered public accounting firm to audit the books, records and accounts of the Company and its subsidiaries for the year ending December 31, 2019.2021. A representative of KPMG LLP will be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Information regarding the aggregate fees billed by KPMG LLP for the years ended December 31, 2018, December 31, 20172020 and December 31, 20162019 for (i) professional services rendered for the audit of the Company’s annual financial statements and the reviews of the financial statements included in the Company’s reports on Form 10-Q during such year (“Audit Fees”), (ii) assurance and related services that are reasonably related to the performance of the audit or review of the Company financial statements but are not included in Audit Fees, (iii) professional services rendered for tax compliance, tax advice or tax planning, and (iv) other products and services is reported below under the heading “Audit and Certain Other Fees Paid Accountants.”

Voting Standard. For the ratification of the Audit Committee’s selection of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2019,2021, the affirmative vote of the holders of a majority of the shares of Preferred Stock and of the holders of a majority of the shares of Common Stock, present in person or by proxy and entitled to vote at the meeting, is required. Abstentions with respect to the vote on ratification of the appointment of KPMG LLP as our independent registered public accounting firm will have the same effect as a vote against the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANT.

6

PROPOSAL 3 –

ADOPT AN ADVISORY RESOLUTION TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provides that the Company’s stockholders have the opportunity to vote to approve, on an advisory (nonbinding) basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement in accordance with the Securities and Exchange Commission’s (“SEC”) rules. Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, the Company is presenting the following “say-on-pay” proposal, which gives stockholders the opportunity to approve or not approve the Company’s compensation program for named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, by voting for or against the resolution set out below. While our Board intends to carefully consider the stockholder vote resulting from this proposal, the final vote is advisory in nature and will not be binding on the Company.

The Board and the Company’s Human Resources and Compensation Committee value the opinions of our stockholders, and to the extent there is any significant vote against the named executive officer compensation as disclosed in this Proxy Statement, the Company, the Board and the Human Resources and Compensation Committee will consider the results of the vote in future compensation deliberations.

In addition to the advisory vote on executive compensation, the Dodd-Frank Act requires that stockholders have the opportunity to vote on how often they believe the advisory vote on executive compensation should be held in the future. The Dodd-Frank Act requires that stockholders have such opportunity to vote on the frequency of say-on-pay votes every six years after the initial vote. The Company held the initial frequency vote at the 2011 Annual Meeting of Stockholders, where the stockholders voted for holding a say-on-pay vote every year. The Company held the most recent frequency vote at the 2017 Annual Meeting of Stockholders, where the stockholders voted for holding a say-on-pay vote every year. The next frequency vote will occur at the 2023 Annual Meeting of Stockholders, and the next say-on-pay vote will occur at the 20202022 Annual Meeting of Stockholders.

At the 20182020 Annual Meeting of Stockholders, all of the shares of Preferred Stock and more than 98%99% of the shares of Common Stock voting on the matter voted in favor of our say-on-pay proposal, reflecting broad stockholder support for the Company’s compensation of its named executive officers.

Voting Standard. For the advisory vote seeking approval of a resolution to approve named executive officer compensation, the affirmative vote of the holders of a majority of the shares of Preferred Stock and of the holders of a majority of the shares of Common Stock, voting as separate classes, present in person or by proxy and entitled to vote at the meeting, is required. Abstentions with respect to the advisory vote on the approval of a resolution to approve named executive officer compensation will have the same effect as a vote against the proposal. Broker non-votes will be treated as shares present for quorum purposes but not entitled to vote, so they will not affect the outcome of the vote on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS AN ADVISORY VOTE “FOR” THE FOLLOWING RESOLUTION: “RESOLVED, THAT THE STOCKHOLDERS OF MGP INGREDIENTS, INC. APPROVE, ON AN ADVISORY BASIS, COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS, AS DISCLOSED PURSUANT TO ITEM 402 OF REGULATION S-K, INCLUDING THE COMPENSATION OVERVIEW, COMPENSATION TABLES AND NARRATIVE DISCUSSION.”

7

BOARD OF DIRECTORS

Listed below are the eightnine nominees for election as a director, eachdirector. All nominees with the exception of whomNeha J. Clark, Thomas A. Gerke, Donn Lux, and Kevin S. Rauckman currently serves on the Board.serve as directors. Each director elected at the Annual Meeting will serve a one-year term.

Information Regarding Director Nominees

Directors and Board Nominees | Age1 | Class of Director2 | Dates of Service on MGP Board | Current Service on MGP Board | |||||||||||||||||||

David J. Colo | Group | August 2015-present | |||||||||||||||||||||

| Anthony P. Foglio | Group | May 2014-present | Audit Nominating and Governance | ||||||||||||||||||||

| Group B | |||||||||||||||||||||||

Human Resources and Compensation Nominating and Governance | |||||||||||||||||||||||

Karen L. Seaberg Board Chairman | Group B | August 2009-present Chairman from December 2014-present | Human Resources and Compensation Nominating and Governance | ||||||||||||||||||||

M. Jeannine Strandjord Audit Committee Chairman | Group B | December 2013-present | Audit Human Resources and Compensation Nominating and Governance | ||||||||||||||||||||

| Neha J. Clark | 45 | Group A | No prior service | None | |||||||||||||||||||

| Thomas A. Gerke | 64 | Group A | No prior service | None | |||||||||||||||||||

| Donn Lux | 60 | Group A | No prior service | None | |||||||||||||||||||

| Kevin S. Rauckman | 59 | Group A | No prior service | None | |||||||||||||||||||

1All ages are as of April 9, 2019.26, 2021.

2Group A indicates the director is elected by holders of Common Stock. Group B indicates the director is elected by holders of Preferred Stock. Mr. Foglio currently serves as a Group A director but has been nominated by the Board to stand for election as a Group B director.

3Mr. Colo served on the Audit, Human Resources and Compensation, and Nominating and Governance Committee until he resigned from them in connection with his appointment as President and Chief Operating Officer.

8

Board Nominees

DAVID J. COLO

Mr. Colo has been the Company’s Chief Executive Officer since May 2020 and the President since March 2020. He also served as the Company’s Chief Operating Officer from March 2020 to May 2020. Prior to joining the Company, he served as President, Chief Executive Officer and a director of SunOpta, Inc. from February 2017 to February 2019. He served as Executive Vice President and Chief Operating Officer of Diamond Foods, Inc. from 2013 until March 2016. He joined Diamond Foods in 2012 as Executive Vice President of Global Operations and Supply Chain. For the three years prior to joining Diamond Foods, Mr. Colo served as an independent industry consultant focusing on organizational optimization and planning. From 2003 to 2005, he served as President of ConAgra Food Ingredients. Before his employment at ConAgra Foods, Mr. Colo spent several years with Nestle-Purina Pet Care Company in roles of increasing responsibility, including Vice President of Supply for the company’s Golden Products Division, and Vice President of Store Brands and Venture Development. He also served two years as President of the American Dehydrated Onion and Garlic Association. The Company believes that Mr. Colo’s qualifications to serve on the Board include his extensive management experience and his experience in the food industry.

ANTHONY P. FOGLIO

Mr. Foglio’s career spans over 40 years in the alcohol beverage industry. From 2010 to 2017 he served as a partner of Anchor Brewers and Distillers, and has served as chairman of and partner its successor entity, Hotaling & Co., since 2017. From 2008 until 2010, he served as the Chairman of Preiss Imports, which merged into Anchor Brewers and Distillers. He served as the Chairman of Skyy Spirits, LLC from 2006 to 2008 and as the President and CEO of Skyy Spirits from 1998 to 2006. Mr. Foglio helped Skyy Spirits become a multi-brand portfolio, spanning a variety of categories, including vodkas, tequilas, rums, gins, whiskeys, cordials, liqueurs and distinctive Campari brands. During his career, Foglio has fostered profitable growth and development of world-renowned brands including SKYY Vodka, 1800 Tequila, Smirnoff Vodka, Bailey’s Irish Cream, Jose Cuervo Tequila, and J & B Scotch, and is now leading the focus within the craft spirits world via Hotaling & Co. The Company believes that Mr. Foglio’s qualifications to serve on the Board include his extensive expertise and experience in the alcohol beverage industry and management of the growth and development of multi-brand portfolios.

LORI L.S. MINGUS

Ms. Mingus’ career began in graphic design in 1996. She has worked as a designer for public companies, national associations and an advertising agency. She is a principal and owner of Torpa Design Co., specializing in all facets of graphic design, interior and exterior design since 2005. Ms. Mingus serves as a trustee on the Evan C. GRIFFIN

Seaberg.

9

KAREN L. SEABERG

Ms. Seaberg has been Chairman of the Board of the Company since December 2014 and a director since 2009. Ms. Seaberg is a member of the Heartland chapterChapter of National Association of Corporate Directors and the Kansas City chapterChapter of WomenCorporateDirectorsWomen Corporate Directors (WCD). She has been an executive travel agent and minority owner of Travel Center of Atchison for 31 years. Ms. Seaberg is active in civic affairs at both the local and national level. She was instrumental in the creation of Atchison’s $4.2 million Riverfront Park in 2004 and was the Kansas Governor’s Chair for the national Lewis and Clark Bicentennial Commemoration in 2002-2006, bringing one of 15 national events to Atchison, Leavenworth and Kansas City in 2004. She also served on the Lewis & Clark Trail Heritage Foundation board, a national not-for-profit based in Great Falls, MT, from 2003 to 2007 and as its national president from 2007 to 2008. Ms. Seaberg has been the chair of the annual Amelia Earhart Festival since 1997, which brings over 40,000 people to Atchison every year in July. Ms. Seaberg served on the Atchison Hospital Board from 1990 to 2004, and presently serves on the Boardboard of the Cray Medical Research Organization at the University of Kansas Medical Center, Kansas City, Kansas. She also serves as a board member of the national Lewis and Clark Trust and is chair of the Atchison Amelia Earhart Foundation. In 2015, she was recipient of the Hall of Fame award from the Chamber of Commerce and the Vision of Excellence award from the Santa Fe Depot Trustees in Atchison, Kansas. She is the cousin of George W. Page, Jr. The Company believes that Ms. Seaberg’s qualifications to serve on the Board include her business and civic experience and organizational skills, her knowledge of the Company and the industries in which it operates, her familiarity with the community in which the Company operates and her significant stock ownership. Ms. Seaberg is Ms. Mingus's mother.

M. JEANNINE STRANDJORD

Ms. Strandjord has over 40 years of financial management experience and was employed in three different and diverse industries after starting in public accounting on the audit staff of Ernst and Whinney in 1968. For 20 years, beginning in 1985, she held several senior financial and related senior management roles at Sprint Corporation. She managed the successful transformation and restructuring of Sprint as Chief Integration Officer from 2003 until 2005 when she retired. She was Senior Vice President and Chief Financial Officer of Global Solutions, a $9 billion division, from 1998 until 2003 and was Controller and Treasurer for Sprint Corporation from 1986 to 1998. Ms. Strandjord has beenwas a director of American Century Mutual Funds (for six registered investment companies) since 1994.from 1994 to 2018. From 1996 through May 2012, she was a director of DST Systems, Inc., where she chaired the Audit Committee and sat on the Compensation Committee and Governance and Nominating Committee. Ms. Strandjord has been a director of Euronet Worldwide, Inc. (“Euronet”) since 2001. Ms. Strandjord was Euronet’s Lead Independent Director from 2010 to 2014 and continues to be the Chairman of Euronet’s Audit Committee. The Company believes that Ms. Strandjord’s qualifications to serve on the Board include her experience on the boards of various other public companies, as well as her background in finance, corporate governance, restructuring, talent management, and compensation and benefits.

NEHA J. CLARK

Ms. Clark has been the Chief Financial Officer of Brunswick Boat Group, a division of Brunswick Corporation (NYSE: BC), a leading global designer, manufacturer, and marketer of recreational marine products, since March 2019. From August 2018 to November 2018, she was the Chief Financial Officer of Lifeway Foods, Inc. (Nasdaq: LWAY), a manufacturer and marketer of beverages and dairy products. From January 2016 to August 2018, she was the Chief Financial Officer of Coveris North American Food & Consumer Flexibles/Chief Transformation Officer of Coveris Americas, a leading producer of flexible packaging. From 1999 to 2015, she was employed by Kraft Foods, with increasing levels of responsibility, most recently as Director of Finance—Grocery Business. From 1997 to 1999, she was a senior auditor with Grant Thornton LLP. The Company believes that Ms. Neha’s qualifications to serve on the Board include her significant financial, accounting and public company leadership experience.

THOMAS A. GERKE

Mr. Gerke is the General Counsel and Chief Administrative Officer at H&R Block (NYSE: HRB), a global consumer tax services provider. Since joining H&R Block in January 2012, at various times Mr. Gerke has had additional responsibilities, including leadership of the human resources function and serving as interim Chief Executive Officer. From January 2011 to April 2011, Mr. Gerke served as Executive Vice President, General Counsel and Secretary of YRC Worldwide, a Fortune 500 transportation service provider. From July 2009 to December 2010, Mr. Gerke served as Executive Vice Chairman of CenturyLink, a Fortune 500 integrated communications business. From December 2007 to June 2009, he served as President and CEO at Embarq, then a Fortune 500 integrated communications business. He also held the position of Executive Vice President and General Counsel – Law and External Affairs at Embarq from May 2006 to December 2007. From October 1994 through May 2006, Mr. Gerke held a number of executive and legal positions with Sprint, serving as Executive Vice President and General Counsel for over two years.

10

Mr. Gerke is also a former member of the board of directors of Tallgrass Energy GP, LLC, which is the general partner of Tallgrass Energy, LP, CenturyLink; Embarq, and the United States Telecom Association. In addition, he is a former member of the Rockhurst University Board of Trustees and The Greater Kansas City Local Investment Commission Board of Trustees. He currently serves as a board member of Consolidated Communications Holdings, Inc. (Nasdaq: CNSL), a leading broadband and business communications provider. The Company believes that Mr. Gerke’s qualifications to serve on the Board include his experience on the boards and as an executive of various other public companies.

DONN LUX

Mr. Lux was President and Chief Executive Officer, from 1991 until March 2021, and Chairman, from 2010 until March 2021, of Luxco, Inc., a leading branded beverage and alcohol company that was acquired by the Company on April 1, 2021. He was also Chairman and Chief Executive Officer of Limestone Branch Distillery, LLC from November 2014 until its acquisition by the Company on April 1, 2021, and of Lux Row Distillers LLC from February 2016 until its acquisition by the Company on April 1, 2021. Mr. Lux serves on the boards of the American Distilled Products Association, The National Alcohol Beverage Control Association (NABCA) Industry Advisory Committee, and the St. Louis Regional Business Council (RBC).His philanthropic activities include serving on the boards of Social Venture Partners (RBC), the University City Children’s Center and the Lux Family Foundation.The Company believes that Mr. Lux’s qualifications to serve on the Board include his leadership skills, his extensive expertise and experience in the beverage alcohol industry, his former role as CEO of Luxco, his management of the growth and development of multi-brand portfolios, and his significant stock ownership.

KEVIN S. RAUCKMAN

Mr. Rauckman is the owner of, and financial consultant for, Rauckman Advisors, LLC, where he has worked since November 2017. Mr. Rauckman served as the Chief Financial Officer and Treasurer of Garmin Ltd. (Nasdaq:GRMN) from January 1999 until December 2014 before taking early retirement from that role. He was named CFO of the Year by the Kansas City Business Journal in 2008. Mr. Rauckman now serves as a board member and the Audit Committee Chairman of CrossFirst Bankshares, Inc. (Nasdaq: CFB), in a role has held since May 2016. He also serves as a board member and audit committee chairman of JE Dunn Construction Group, a role he has held since January 2017, and on the board of Tesseract Ventures, LLC, a role he has held since December 2018. The Company believes that Mr. Rauckman’s qualifications to serve on the Board include his public company experience on the boards of other companies and his significant financial, corporate governance, leadership, operational, and strategic planning skills.

CORPORATE GOVERNANCE AND COMMITTEE REPORTS

The Board; Standing Committees; Meetings; Independence

The Board of Directors believes that a majority of the directors should be independent and has determined that the following directors are independent: James L. Bareuther, David J. Colo, Terrence P. Dunn, Anthony P. Foglio, George W. Page, Jr., Lynn H.M. Jenkins, Lori L.S. Mingus, Karen L. Seaberg, Kerry A. Walsh Skelly, and M. Jeannine Strandjord. In determining the independence of directors, the Board found that none of the independent directors has any material relationship with the Company other than as a director. In making these determinations, the Board considers all facts and circumstances as well as the standards defined in Rule 4200(a)(15) of the NASDAQ Stock Market.

The Board's standing Committees include the Audit Committee, the Nominating and Governance Committee, and the Human Resources and Compensation Committee. The compositioncurrent members of these Committees is described under “Boardthe Audit Committee are M. Jeannine Strandjord (Chair), James L. Bareuther, Terrence P. Dunn, Anthony P. Foglio, Lynn M. Jenkins, and Kerry A. Walsh Skelly. The current members of Directors.”the Nominating and Governance Committee are Terrence P. Dunn (Chair), James L. Bareuther, Anthony P. Foglio, Lynn M. Jenkins, Lori L.S. Mingus, Kerry A. Walsh Skelly, Karen L. Seaberg, and M. Jeannine Strandjord. The current members of the Human Resources and Compensation Committee are James L. Bareuther (Chair), Terrence P. Dunn, Lynn M. Jenkins, Lori L.S. Mingus, Karen L. Seaberg, Kerry A. Walsh Skelly, and M. Jeannine Strandjord.

All of the members of the Nominating and Governance Committee are determined independent under the NASDAQ listing rules.

The members of the Audit Committee are independent under the NASDAQ listing rules and meet the applicable independence requirements of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended. The members of the Human Resources and Compensation Committee are also determined independent under the NASDAQ listing rules and applicable rules of the Securities and Exchange Commission. Each director on the Committees is a “non-employee” director as defined in Rule 16b-3(b)(3) promulgated under the Securities Exchange Act of 1934 and an “outside” director as defined under Section 162(m) of the Internal Revenue Code.

11

The Board meets immediately after each Annual Meeting of the stockholders and may hold other regular and special meetings. The meetings are led by the ChairpersonChairman of the Board. During 2018,2020, the Board met sevenfourteen times, the Audit Committee met eightnine times, the Human Resources and Compensation Committee met foursix times, and the Nominating and Governance Committee met four times. Each non-employee director attended more than 75% of the meetings of the Board and the Committees of which the director was a member.

Corporate Governance Documents

Our key governance documents include:

•Code of Conduct;

•Charters of each of the Audit Committee, Human Resources and Compensation Committee, and the Nominating and Governance Committee;

•Corporate Governance Guidelines; and

•Stock Ownership Guidelines.

All of these documents are available on our website at www.mgpingredients.com in the For Investors / Governance section and a copy of any of these documents will be sent to any stockholder upon request.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling the Board’s oversight responsibilities with respect to the quality and integrity of the financial statements, financial reporting process, and systems of internal controls. The Audit Committee also assists the Board in monitoring the independence and performance of the independent registered public accountant and the internal audit department. It also reviews and makes recommendations with regard to the process involved in the Company’s implementation of its conflict of interest and business conduct policy, is responsible for establishing and monitoring compliance under the code of conduct applicable to the chief executive and financial officers, and oversees the Board’s risk management process. In connection with this work, the Committee engages in regular discussions of the Company’s risks with senior management, internal auditors, and external auditors, and annually reviews: (a) the adequacy of the Audit Committee’s written charter that has been adopted by the Board of Directors; (b) the independence and financial literacy of each member of the Audit Committee; (c) the plan for and scope of the annual audit; (d) the services and fees of the independent auditor; (e) certain matters relating to the independence of the independent auditor; (f) certain matters required to be discussed with the independent auditor relative to the quality of the Company’s accounting principles; (g) the audited financial statements and results of the annual audit; (h) recommendations of the independent auditor with respect to internal controls and other financial matters; (i) significant changes in accounting principles that are brought to the attention of the Committee; and (j) various other matters that are brought to the attention of the Committee.

The Board has determined that M. Jeannine Strandjord, James L. Bareuther, David J. Colo, Terrence P. Dunn, Anthony P. Foglio, George W. Page, Jr.Lynn M. Jenkins and Lynn H. JenkinsKerry A. Walsh Skelly are independent, as independence for audit committees is defined in the applicable listing standards of the NASDAQ Stock Market. The Board of Directors has determined that each ofM. Jeannine Strandjord, David J. Colo, Terrence P. Dunn and Anthony P. Foglio is an “audit committee financial expert,” as defined in Item 407(d)(5) of SEC Regulation S-K. Under SEC regulations, a person who is determined to be an audit committee financial expert will not be deemed an “expert” for any purpose, including without limitation for purposes of Section 11 of the Securities Act of 1933. Further, the designation or identification of a person as an audit committee financial expert does not impose any duties, obligations, or liability on such person that are greater than the duties, obligations, or liability imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification and does not affect the duties, obligations, or liability of any other member of the audit committee or board of directors.

Audit Committee Report

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors and oversees the entire audit function including the selection of an independent registered public accounting firm. Management has the primary responsibility for the consolidated financial statements and the financial reporting process including internal control over financial reporting and the Company’s legal and regulatory compliance. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements for the year ended December 31, 2018.2020. The Audit Committee also discussed with the Chief Executive Officer and Chief Financial Officer their respective certifications with respect to the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.2020.

12

The Audit Committee has reviewed and discussed the matters as are required to be discussed with the independent registered public accounting firm in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB) including those matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees; has received the written disclosures and letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee; and has discussed with the independent auditor the auditor’s independence. Based on such review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for 20182020 be included in the Company’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

Audit Committee Members: M. Jeannine Strandjord (Chair)

| M. Jeannine Strandjord (Chair) | ||

| James L. Bareuther | ||

| Terrence P. Dunn | ||

| Anthony P. Foglio | ||

| Lynn M. Jenkins | ||

| Kerry A. Walsh Skelly | ||

The Audit Committee Report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Nominating and Governance Committee

The purposes of the Nominating and Governance Committee are to recommend to the Board the qualifications for new director nominees, candidates for nomination and policies concerning compensationboard succession, corporate governance, and director length of service.

In identifying nominees for the Board of Directors, the Nominating and Governance Committee relies on personal contacts of the committee members and other members of the Board of Directors and management. The Nominating and Governance Committee will also consider candidates recommended by stockholders in accordance with its policies and procedures. However, the Nominating and Governance Committee may choose not to consider an unsolicited candidate recommendation if no vacancy exists on the Board. The Nominating and Governance Committee may, in its discretion, use an independent search firm to identify nominees. Ms. Jenkin's nomination was first recommended to the Nominating and Governance Committee by the Company's Chief Executive Officer.

In evaluating potential nominees, the Nominating and Governance Committee determines whether the nominee is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. The Nominating and Governance Committee will conduct a check of the individual’s background and generally will conduct personal interviews before recommending any candidate to the Board. The Nominating and Governance Committee in its sole discretion may require candidates (including a stockholder’s recommended candidate) to complete a form of questionnaire providing information required to be disclosed in the Company’s proxy statement.

Stockholders who wish to recommend candidates for consideration by the Nominating and Governance Committee in connection with next year’s Annual Meeting should submit the candidate’s name and the information set forth below in writing to the chairpersonchairman of the Nominating and Governance Committee, in care of the Company’s Secretary, at Cray Business Plaza, 100 Commercial Street, P.O. Box 130, Atchison, Kansas, 66002, on or after January 23, 2019 and onFebruary 17, 2022 or before February 22, 2019.March 19, 2022. In addition to the name of the candidate, a stockholder should submit:

•his or her own name and address as they appear on the Company’s records;

13

•if not the record owner, a written statement from the record owner of the shares that verifies the recommending stockholder’s beneficial ownership and period of ownership and that provides the record holder’s name and address as they appear on the Company’s records;

•a statement disclosing whether such recommending stockholder is acting with or on behalf of any other person, entity or group and, if so, the identity of such person, entity or group;

•the written consent of the person being recommended to being named in the proxy statement as a nominee if nominated and to serving as a director if elected; and

•pertinent information concerning the candidate’s background and experience, including information regarding such person required to be disclosed in solicitations of proxies for election of directors under Regulation 14A of the Securities Exchange Act of 1934, as amended.

Human Resources and Compensation Committee

The Human Resources and Compensation Committee recommends to the Board of Directors the salary and incentive compensation of the Chief Executive Officer and other executive officers of the Company.Company as well as director compensation and benefits. The Committee reviews the scope and type of compensation plans for other management personnel and makes recommendations to the Board with respect to equity-based plans that are subject to Board approval. The Committee administers the Company’s stock option and restricted stock plans, and also serves as an executive search committee. Each Committee member qualifies as a non-employee director under SEC Rule 16b-3 and as an outside director for purposes of Internal Revenue Code Section 162(m).16b-3. The Committee has a charter, which may be found on the Company’s website at www.mgpingredients.com.

The Committee typically meets four or five times a year and generally considers and recommends various components of the Company’s compensation programs at regularly scheduled times throughout the year. Such programs typically originate as recommendations of management. It has typically conducted performance and salary reviews of the Chief Executive Officer and receives the Chief Executive Officer’s performance reviews and salary recommendations for other officers at its December meeting. It generally considers long-term incentive awards and performance goals for annual cash incentives in February.

When considering compensation matters, the Committee relies upon the experience of its members, the recommendations of management and outside consultants retained by the Committee.

See “Compensation Discussion and Analysis - Compensation Overview – How We Determine Compensation” for further information on the processes we follow in setting compensation.

Human Resources and Compensation Committee Report

We reviewed and discussed with management the “Compensation Discussion and Analysis” section of this Proxy Statement. Based on such review and discussion, we recommended to the Board that this Proxy Statement include the “Compensation Discussion and Analysis.”

Human Resources and

Compensation Committee Members: David J. Colo (Chair)

| James L. Bareuther (Chair) | ||

| Terrence P. Dunn | ||

| Lynn M. Jenkins | ||

| Lori L.S. Mingus | ||

| Karen L. Seaberg | ||

| Kerry A. Walsh Skelly | ||

| M. Jeannine Strandjord | ||

14

Board Leadership Structure

Our Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board. The Board believes it is in the best interest of the Company to make that determination in a manner it believes best provides appropriate leadership for the Company at the time, based on the circumstances and direction of the Company and the membership of the Board. Our current structure does not combine the positions of Chief Executive Officer and Chairman of the Board of Directors, the latter also acting in the capacity of lead director. Augustus C. GriffinDavid J. Colo is currently our Chief Executive Officer and is responsible for day-to-day leadership of the Company. Karen L. Seaberg serves as the Chairman of the Board. The Board of Directors believes this is the most appropriate structure for the Company at this time, as it permits the President and Chief Executive Officer to focus his attention on managing our day-to-day business and enhances the ability of the Board of Directors to provide strong oversight of the Company’s management and affairs.

Board Diversity

Under our Corporate Governance Guidelines, the Nominating and Governance Committee seeks a wide array of skills, knowledge and diverse backgrounds and perspectives, and takes those into account when evaluating the composition of our Board of Directors. Our Board of Directors currently includes five women and directors ranging in age from 50 to 75. Our nominees for director include four women and one ethnic minority and directors ranging in age from 45 to 75. In addition, each director contributes to the Board’s overall diversity by providing a variety of perspectives based on distinct personal and professional experiences and backgrounds. We are committed to maintaining and enhancing the diversity of backgrounds and experiences of our board of directors and in furtherance of this, the Board and the Nominating and Governance Committee conduct annual self-evaluations to assess their performance and effectiveness, including consideration of the array of skills, knowledge and diverse backgrounds and perspectives on the Board.

15

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Overview

This discussion provides an overview and analysis of our compensation programs and policies, the compensation decisions we made under those programs and policies, and the factors we considered in making those decisions. We also provide a series of tables that present information about the compensation earned or paid in each of 2016, 2017,2018, 2019, and 20182020 to our named executive officers, including:

•David E. Rindom – Mr. Rindom served as Vice President, Human Resources from June 2000 until December 2015, when he was appointed Vice President and Chief Administrative Officer.

•David E. Dykstra – Mr. Dykstra has served as Vice President, Alcohol and Marketing since 2009.

•Stephen J. Glaser – Mr. Glaser has served as Vice President of Production and Engineering since October 2015.

•Augustus C. Griffin – Mr. Griffin served as President and Chief Executive Officer from July 2014 until March 2020 and as Chief Executive Officer until his retirement from the Company in May 2020.

The discussion below is intended to help you understand the information provided in the tables and put that information into context within our overall compensation program.

Objectives of our Compensation Program

Our compensation program objectives are to align compensation programs with our business objectives and stockholders’ interests, to reward performance, to be externally competitive and internally equitable, and to retain talent on a long-term basis. In particular, our philosophy is to balance salary and benefits with incentive and equity compensation so that the interests of the executive officers will be aligned with those of stockholders.

Components of Our Compensation Program

The principal components of our compensation program are base salary, annual cash incentive awards, long-term equity incentives, and equity- and non-equity-based retirement compensation.

•Base salary is designed to attract and retain executives over time. In setting base salaries, our objectives are to assure internal fairness of pay in terms of job size, external competitiveness so that we can attract and retain needed talent, and a consistent, motivating system for administering compensation. Base salaries of named executive officers are reflected in the Salary column of the Summary Compensation Table.

16

•Long-Term Incentives, which have in recent years been in the form of restricted stock units, are intended to motivate the achievement of key long-term financial performance goals and thereby generate stockholder value, provide management an opportunity to increase ownership of our stock, help attract and retain key employees, and be cost efficient. The Human Resources and Compensation Committee’s typical practice is to grant awards made with respect to a year as soon as practicable following the close of the year based on the performance during that year. In accordance with the rules of the Securities and Exchange Commission relating to the reporting of stock awards, such awards are included in the Summary Compensation Table for the year in which they were made, rather than in the year to which they relate. The grant date fair values of awards, computed in accordance with FASB ASC Topic 718, made during 2020, 2019, and 2018 2017 and 2016 to the named executive officers are shown in the Stock Awards column of the Summary Compensation Table. Awards made with respect to 20182020 performance were made in early 2019,2021, and are, therefore, not included in the Summary Compensation Table. Awards made with respect to 20172019 were made in early 20182020 and are included in the Summary Compensation Table. Any dividends paid on restricted stock units during a period are included in the All Other Compensation column of the Summary Compensation Table for the period in which they are paid.

•Non-Equity-Based Retirement Compensation, provided through our 401(k) plan and our non-qualified deferred compensation plan, permits employees to, among other things, reduce their current income taxes by making limited pre-tax contributions to increase, enhance and diversify their retirement savings. Named executive officers participate in the 401(k) plan on the same basis as other eligible employees. Amounts, if any, contributed by the Company under the 401(k) plan are included in the All Other Compensation column of the Summary Compensation Table. In 2018 the Company adopted a non-qualified deferred compensation plan for its executive officers. The deferred compensation plan permits participants to defer salary or short termshort-term incentive payments. Amounts deferred are deemed invested in investments selected by the participant from a limited number of choices available in the Company's 401(k) plan.Mr. Griffin,Gall, Mr. PigottGlaser, and Mr. Rindom participated in the deferred compensation plan in 2018,2020, and each deferred a portion of their short-term incentive paid in 2019.2021.

Consideration of Say-On-Pay Results

At the 20182020 Annual Meeting of Stockholders, all of the shares of Preferred Stock and more than 98%99% of the shares of Common Stock voting on the matter voted for the approval of compensation of the Company’s named executive officers. We believe this indicates stockholder confidence in our pay for performance philosophy.

How We Determine Compensation

As noted elsewhere in this Proxy Statement, our Human Resources and Compensation Committee recommends to the Board of Directors the salary and incentive compensation of the Chief Executive Officer and other executive officers of the Company. The Committee reviews the scope and type of compensation plans for other management personnel and makes recommendations to the Board with respect to equity-based plans that are subject to Board approval. The Chief Executive Officer provides the Committee with performance reviews and salary recommendations for other officers.

The Committee has unrestricted access to management. It may also request the participation of management or the Committee’s independent consultant at any meeting or executive session. Committee meetings are regularly attended by the Chief Executive Officer, except for executive sessions and discussions of his own compensation and the Committee’s independent consultant. The Committee regularly reports to the Board on compensation matters and annually reviews the Chief Executive Officer’s compensation with the Board in an executive session of non-management directors only.

The Committee has sole discretion, at Company expense, to retain and terminate independent advisors, including sole authority to approve the fees and retention terms for such advisors, if it shall determinedetermines the services of such advisors to be necessary or appropriate.

17

Base Salary. Our Vice President – Chief Administrative Officer develops a summary of the titles and job descriptions of senior officers and other employees and submits them to a retained compensation consultant, which maintains survey data for similar-sized manufacturing firms. A retained compensation consultant prepares a report identifying the ranges of compensation at these companies for persons with similar responsibilities to those employees described in the company-prepared summary. In addition, annually we obtain from a retained compensation consultant updated information regarding average pay increases at the companies for which a retained compensation consultant maintains survey data. This survey information, or summaries thereof, is provided to the Human Resources and Compensation Committee. The Committee reviews this information and considers any recommendation made by the Chief Executive Officer with respect to other named executive officers andofficers. The Committee then tries to assure that each officer’s base compensation falls within a range that is within 80% to 120% of a specified percentile of salaries paid to executives holding comparable positions at the surveyed companies. Although the ultimate goal is to compensate executive officers at the midpoint of this targeted range for comparable positions at companies within the survey, a particular individual’s salary may fall above or below the targeted level because of his or her tenure, experience level, or performance. The Human Resources and Compensation Committee has approved the 50th percentile of the market as the target for base salaries.

When made, annual adjustments usually take place after the start of the next year, but are retroactive to the start of such year. When making annual adjustments, the Human Resources and Compensation Committee generally uses a matrix format that takes into account each executive’s performance review and the extent to which his or her salary is above or below the midpoint for comparable positions. Adjustments sometimes occur at other times of the year as a result of a promotion or other change in duties.

Annual Cash Incentive. We believe a significant portion of the compensation of senior managers should be incentive based, and that by rewarding good performance, such arrangements help align the interests of our named executive officers with those of our stockholders. The goal of our annual program is to align more closely how we compensate employees with our business strategy. Specifically, we want to encourage employees to think about how they can contribute to driving Company profitability, reduce costs for goods and equipment, and create efficiencies to improve our ongoing operations. We reward them for success by basing annual cash bonuses on the attainment of performance metrics that correspond with the creation of shareholder value.

Short-Term Incentive Plan

Plan.The Company's Short-Term Incentive Plan (the “STI Plan”) is designed to motivate and retain Company officers and employees and to tie their short-term incentive compensation to achievement of certain profitability goals of the Company.

Pursuant to the STI Plan, short-term incentive compensation is dependent on the achievement of certain performance metrics by the Company established by the Board of Directors and certain individual qualitative objectives. Each performance metric is calculated in accordance with the rules approved by the Human Resources and Compensation Committee. For 2018,2020, such performance metrics were operating income, EBITDA, and earnings per share (EPS), each calculated as presented in the table below. Operating income was the core measure of performance under the STI Plan, reflecting the belief that this measure of performance is the most sensitive to management's performance. EBITDA is a common metric used by shareholders to measure performance and EPS reflects the Company's full financial performance. These quantitative goals represent 90% of the total short-term incentive. In addition, 10% of the total incentive was based on qualitative goals. Payments at any of these levels of performance were conditioned upon there being no uncured default in compliance with the Company’s debt covenants under its Credit Agreement and on minimum put-away of 25,000 barrels of premium whiskey, reflecting investment for the future. Levels in the table below for operating income and EBITDA are shown in thousands. The performance metrics listed below exclude the impact of bonus payments made as a result of achievement of these metrics under the STI Plan.

| Weighting | Minimum Payout 50% | Plan Payout 100% | Maximum Payout 200% | |||||||||||||||||||||||

| Operating Income | 70% | $ | 49,989 | $ | 56,280 | $ | 69,393 | |||||||||||||||||||

| EBITDA | 20 | 62,891 | 69,182 | 82,295 | ||||||||||||||||||||||

| Earnings per share | 10 | 2.12 | 2.40 | 2.98 | ||||||||||||||||||||||

Weighting | Minimum Payout 90% | Plan Payout 100% | Maximum Payout 200% | |||||||||||

| Operating Income | 70% | $ | 42,909 | $ | 47,200 | $ | 56,640 | |||||||

| EBITDA | 20 | 54,218 | 58,500 | 67,940 | ||||||||||

| Earnings per share | 10 | 1.79 | 2.02 | 2.43 | ||||||||||

The Human Resources and Compensation Committee determines the officers and employees eligible to participate under the STI Program for the plan year as well as the target annual incentive compensation for each participant for each plan year.

18

For 2018,2020, the Human Resources and Compensation Committee adjusted the Company's actual results to exclude certain CEO transition costs and mergers and acquisition fees.The Committee excluded costs of $2,885,000 related to these items, which were not anticipated when the performance targets were determined. The Human Resources and Compensation Committee determined that after reflecting this adjustment for purposes of the STI Plan, before factoring in the impact of bonus payments made as a result of the Company's performance, the Company achieved Operating Income of $50,148,000 and$69,450,000, EBITDA of $61,509,000; these amounts were 106% of target$83,038,000, and 105% of target, respectively. The Human Resources and Compensation Committee also determined that the Company achieved earnings per share of $2.17; this amount was 107%$3.02.The Committee determined performance for each metric met or exceeded the 200% of target.target payout thresholds. As a result of this performance, and after giving effect to the qualitative portion of the STI Plan, in early 2021, Mr. Colo received a payment of $1,025,000, Mr. Gall received a payment of $385,269, Mr. Rindom received a payment of $522,254, Mr. Dykstra received a payment of $329,212, Mr. Glaser received a payment of $310,865, and Mr. Griffin received a payment of $778,055, Mr. Pigott received a payment of $357,313, Mr. Rindom received a payment of $309,391, Mr. Dykstra received a payment of $192,759, and Mr. Glaser received a payment of $179,691.$579,422.

Long-Term Incentives

The 2014 Equity Incentive Plan. On May 22, 2014, stockholders approved the 2014 Equity Incentive Plan. The Board reserved 1,500,000 shares of Common Stock for issuance under the plan. The 2014 Equity Incentive Plan authorizes awards in the form of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, other stock-based awards and cash performance awards. The mix of long-term incentives going forward is expected to continue to be 100% in three-year cliff-vesting restricted stock unit awards. Each named executive officer’s participation level is subject to Human Resources and Compensation Committee discretion. The long-term incentive awards made in any given year under the 2014 Equity Incentive Plan relate to performance for the prior year.

In early 2019,2021, each of the named executive officers received an award of restricted stock units under the 2014 Equity Incentive Plan, related to their performance in 2018.2020 in the amounts presented below.

| 2/11/2021 | ||||||||||||||

| Grant | ||||||||||||||

| # of | date fair | |||||||||||||

| Participant | RSUs | value($) | ||||||||||||

| Mr. Colo | 19,322 | $ | 1,281,250 | |||||||||||

| Mr. Gall | 6,294 | 417,375 | ||||||||||||

| Mr. Rindom | 9,001 | 596,861 | ||||||||||||

| Mr. Dykstra | 6,454 | 427,975 | ||||||||||||

| Mr. Glaser | 6,094 | 404,125 | ||||||||||||

| Mr. Griffin | 10,923 | 724,279 | ||||||||||||

| 2/25/2019 | |||||||

| Grant | |||||||

| # of | date fair | ||||||

| Participant | RSUs | value($) | |||||

| Mr. Griffin | 9,975 | $ | 778,050 | ||||

| Mr. Pigott | 4,576 | 356,928 | |||||

| Mr. Rindom | 3,966 | 309,348 | |||||

| Mr. Dykstra | 2,472 | 192,816 | |||||

| Mr. Glaser | 2,305 | 179,790 | |||||

Retirement Compensation. We provide non-equity-based compensation through our 401(k) plan, a tax-qualified defined contribution plan. The amount of our contributions to the 401(k) plan is determined by the Board each year based on the Human Resources and Compensation Committee’s recommendation. The Committee bases its recommendation primarily upon the recommendations of management as well as Company performance for the year. Our 401(k) plan allows a Company match of 1% for each 1% of employee deferral to a maximum of 6%. Named executive officers participate in the 401(k) plan on the same basis as other employees. Amounts contributed under the 401(k) plan have been allocated to participant accounts in proportion to each participant’s eligible compensation, as defined in the plan. In 2018 the Company adopted a non-qualified deferred compensation plan for its executive officers. The deferred compensation plan permits participants to defer salary or short termshort-term incentive payments. Amounts deferred are deemed invested in investments selected by the participant from a limited number of choices available in the Company's 401(k) plan. Mr. Griffin,Gall, Mr. PigottGlaser, and Mr. Rindom participated in the deferred compensation plan in 2018,2020, and each deferred a portion of their short-term incentive paid in 2019.2021.

Executive Severance Plan. On February 12, 2020, the Company established the MGP Ingredients, Inc. Executive Severance Plan. The plan provides the Company’s executive officers the opportunity to receive severance benefits in the event of certain terminations of employment, with the purpose to attract and retain qualified executives. Pursuant to the plan, upon a qualifying termination (generally, a termination by the Company without cause or a termination by the participant for good reason (each as defined in the plan)) then the participant would receive severance in an amount equal to an applicable severance multiplier (one for any participant who is not the chief executive officer and two for any participant who is the chief executive officer) times the participant’s base salary in effect immediately prior to the date of the termination. In addition, participants would receive a prorated annual bonus based on the Company’s actual performance in the year in which termination occurs. Participants are eligible for reimbursement for certain COBRA premiums for a limited period of time. The plan does not affect the terms of any outstanding equity awards. Any severance benefits payable to a participant under the plan would be reduced by any severance benefits to which the participant would otherwise be entitled under any other severance policy or plan, including any agreement between a participant and the Company (unless the plan or agreement expressly provides for severance benefits to be in addition to those provided under the plan).

19

Other Compensation Programs.Programs. We do not provide executive perquisites of any significance. We also do not have significant executive benefits, such as supplemental executive retirement plans or deferred compensation arrangements.plans. Mr. GriffinColo receives an automobile allowance of $500 per month pursuant to the terms of his employment agreement.agreement, which allowance Mr. Griffin received as well under his employment agreement until his retirement in May 2020.

Employment Agreements and Other Arrangements

In connection with Mr. Colo’s appointment as an officer of the retention of Mr. GriffinCompany, initially as the Company’s President and Chief Operating Officer effective March 16, 2020, and as Chief Executive Officer upon Mr. Griffin’s retirement, the Human ResourcesCompany and Compensation Committee negotiated and recommended to the Board of Directors for approval the Company’s entranceMr. Colo entered into an employment agreement with Mr. Griffin. In 2017, the Committee negotiated and approved the Company’s entrance into a newon February 7, 2020. The employment agreement withsets forth Mr. Griffin to replace the original agreement. Pursuant to the new employment agreement,Colo’s base salary, signing bonus and short-term incentives as follows:

Base Salary. Mr. Griffin was entitled toColo would receive a base salary of $565,000 for 2017, and his$650,000 per year. Mr. Colo’s base salary willwould be reviewed annually by the Human Resources and Compensation Committee annually thereafter duringin accordance with the term. Unlessperformance evaluation practices of the Company, but it may not be decreased without Mr. Griffin is terminatedColo’s consent.

Signing Bonus. Mr. Colo was granted an award of 8,000 restricted stock units under the Company’s 2014 Equity Incentive Plan (the "Equity Plan"), which will vest on March 16, 2023.

Short-Term Incentive. For 2020, Mr. Colo’s target short-term incentive award pursuant to the Company’s short-term incentive plan ("STI Plan") for causethe attainment of the Company’s 2020 performance measures was $650,000, prorated from the effective date of his employment agreement. The amount and timing of payments under the STI Plan will be at the discretion of the Human Resources and Compensation Committee based on the attainment by the Company or terminatesof quantitative performance measures set by the Board and qualitative goals for Mr. Colo determined by the Human Resources and Compensation Committee. For 2020, Mr. Colo’s threshold STI Plan award was 90% of the target STI Plan award and Mr. Colo’s maximum STI Plan award, for attainment of Company performance measures greater than 120% of the target, was 200% of the target award. The terms and conditions of the STI Plan for future years will be reviewed and established annually by the Human Resources and Compensation Committee.

Long-term Incentive. Mr. Colo will be eligible to participate in the Company’s long-term equity incentive program for each fiscal year during which he is employed under the terms of the employment agreement, with an award for each year during its term as determined by the Human Resources and Compensation Committee. The awards made under the Equity Plan in any given year will be for performance for the immediately preceding year pursuant to the Equity Plan. For 2020, the Compensation Committee has approved the long-term incentive goals for his service in 2020, and based on these goals and the Company’s performance in 2020, in February 2021 Mr. Colo received an award of restricted stock units, with performance at target resulting in an award of restricted stock units with a grant date fair value equal to 125% of his base salary, prorated from the effective date of his employment for good reason (each as defined in the employment agreement), the Company will purchase his Atchison, Kansas residence from him following the expirationagreement.

For 2020, Mr. Colo’s threshold LTI award was 90% of the termtarget LTI award and Mr. Colo’s maximum LTI award, for his original purchase priceattainment of $325,000.Company performance measures greater than 120% of the target, was 200% of the target award.

Severance. Except in the event of a voluntary termination by Mr. GriffinColo without good reason, ortermination by the Company with cause, upon a termination other than at the expiration of the term or upon a termination at death or for disability, Mr. GriffinColo will receive severance of (i) two times his base salary. Exceptsalary, (ii) a pro-rata short-term incentive award based on actual performance for the full year in which the eventtermination occurs or the full-year award for any completed year unpaid as of a voluntarythe date of termination, by Mr. Griffin without good reason or by the Company for cause,and (iii) a pro-rata long-term incentive award for the year in which termination occurs or the full-year award for any completed year unpaid as of the date of termination, and an amount equal to $2,000 times the number of full calendar months from the date of termination until the date in which Mr. Griffin and his spouse are Medicare eligible.termination. In addition, except in the limited circumstances described above, upon termination all outstanding RSUs that are then unvested will vest.

Stock Ownership Guidelines